As we all know, the economy has been fluctuating over the past several years, with a high likelihood of this continuing in the future. This means that a nationwide appraisal management company has two options: Manage the changes as they come or allow the challenges of our modern economy to limit their success. We’ve determined three of the biggest challenges that commercial property appraisal companies may face and how appraisers can tackle them to be successful, no matter what the economy currently looks like.

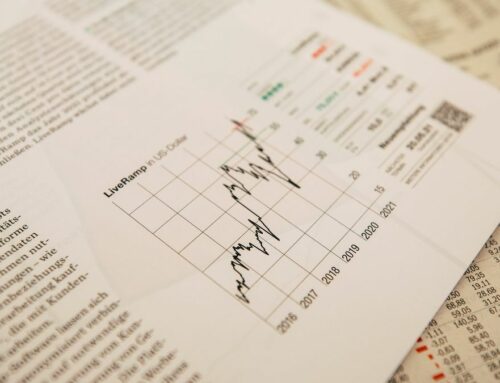

1 – Constantly Fluctuating Rates

The first challenge that a nationwide appraisal management company and its appraisers will face is how constantly different rates will fluctuate. This will keep appraisers on their toes as they must always be checking in on the latest data to ensure they have an accurate appraisal.

There are five different rates that need to be considered in our fluctuating economy: Discount/cap rates, Rental rates, Interest rates, Vacancy rates, and general Economic rates (and data). These five determining factors will “DRIVE” a valuation in a certain direction.

Discount/cap rates

These two rates have a similar function. However, the main difference is that the discount rate refers to the preferences of the investor while a cap rate refers to the property’s market value. Depending on the type of economy we are in, the market value of a property can change as well as the willingness/likelihood of people to invest.

Rental rates

A key factor in commercial real estate valuation is the rental rate of the property. This not only changes depending on the property type but also the area in which the property is located.

Interest rates

According to Home Guides, interest rates deal with what it costs to borrow money. When there are higher interest rates, it is common to find fewer investors willing to buy into commercial properties.

Vacancy rates

Another determining rate factor that nationwide appraisal management companies need to consider is the vacancy rates of properties. This also relates to interest rates because fewer property investors can also lead to higher amounts of vacancies in commercial properties.

Economic rates

Lastly, rates dealing with the current economy and the data that can be gathered about the state we are in also play a role in real estate valuation.

2 – Managing the Different Rates That DRIVE Valuations

Being able to understand the differences in each individual type of rate and how it can affect an appraisal as a whole is crucial in property appraisals at every stage of the economy. In order to have a good idea of where these rates are going in the coming months, it is important to stay up to date with the most accurate data representations for each individual rate type. Only then can you have a clear picture of how the property should be valued as a whole.

In order to manage all of these different rates, property appraisers must continually research where the current rates are and how they can impact each other. This is the best way to not only stay up-to-date but create an accurate commercial appraisal. Putting all of these rates together may seem challenging at times, but it can also be interesting to learn more about how they affect each other in the different economic markets.

3 – Keeping Up With Various Areas of the Country

As a nationwide appraisal management company, the second biggest challenge we at CES have recognized is staying up-to-date all around the country. We have a deep presence in many metro areas and MSAs, meaning that we must have accurate data on all of these areas at any given time.

Although appraisal companies focusing on one area of the country may not have this same issue, they still need to be aware of their current market at all times. However, the obvious challenge comes when a company must juggle varying economic changes in different parts of the country.

While the economy may see fluctuations across the nation as a whole, individual areas and cities reach peaks at different times. This could mean that one area is still struggling with a low economic standing while another part is starting to rise and see those rates discussed above start to lower.

So, how can a property appraiser combat this challenge? In order to provide the most accurate data in our appraisals, we are constantly in contact with bankers, brokers, and players in these different areas. This allows us to stay ahead of the curve and on top of each individual local market.

Preparing for Fluctuations: Work With an Experienced Appraisal Management Company

Overall, the best way to tackle the challenges of our ever-changing economy is to be prepared. Staying up to date with the latest trends and constantly making sure that our information regarding the rates that DRIVE valuations is necessary to provide accurate appraisals at any point in time.

Here at CES, we pride ourselves on being able to stay ahead of the game and utilize the most recent data so our appraisals can be accurate, no matter what our economy currently looks like. If you would like to learn more about our services, contact us today.