This information is for commercial property. This is never done on Residential property. We don’t interpret property. We assess property and provide an opinion.

With market conditions always changing, knowing how to validate a previously-completed appraisal or evaluation is essential for all banking institutions. Validating an appraisal for a property allows you to determine whether or not the previous appraisal is still a valid assessment of the property’s value. Let’s talk about the current validation guidelines, what factors you should consider, and the different ways to approach a validation.

Guidelines For Validating an Appraisal

According to the 2018 Frequently Asked Questions for the Appraisal Regulations and Interagency Appraisal and Evaluation Guidelines, a financial institution does not necessarily have to obtain a new appraisal. However, there are some times when it is necessary to validate a previously-completed appraisal to determine whether there has been any change in property value. This is why performing the validation process is beneficial to banking institutions: it allows you to recognize and document positive or negative value changes.

Although there are not any set rules for performing a validation, there are some guidelines your institution should put in place in order to thoroughly validate a property. For example, you should complete an in-depth review of the real estate’s performance, perform a formal property inspection, and review the property’s income and expense history.

Additionally, your institution’s board of directors should include program policies to make sure that the validation process is complete. According to the December 2010 Interagency Appraisal and Evaluation Guidelines, some of these program guidelines include:

- Ensure that the appraisals contain sufficient information to make a decision

- Establish and maintain criteria for the use of evaluations, monitoring collateral values, and obtaining appraisals if a transaction is not normally covered by agency requirements

- Conduct validations in a professional and unbiased manner

- Enforce internal controls with the goal of compliance

Validation Factors to Consider

All-in-all, it is really up to each individual institution to determine how they will validate previously-completed property appraisals. For example, institutions vary in how long appraisals are considered valid. However, the overall goal of the validation process is to determine whether any negative changes have occurred to the property. In order to determine this, it is important to look at two types of factors: the physical condition of the property and the strength of the real estate market.

The physical condition of the property

There are many factors to consider when it comes to the property’s condition. Many parts of the property or surrounding, competing properties can influence their new value.

For one thing, improvements to the property or surrounding properties can have a major impact on its value. If competing properties have made substantial improvements, the subject property could lose value because it is not as improved as its neighbors.

Additionally, a lack of property maintenance can lower its value, making the previous appraisal no longer valid. This could be seen in the subject property or also in the surrounding properties. A lower market value is generally given to areas with less property maintenance.

Next, zoning, building materials, or technology changes can impact a property’s value. Properties that have not made technological or material advancements are valued as lesser than their competing properties that have made those changes.

Finally, environmental factors are also a part of the physical condition of the property. If there were contaminations or other hazards found, they could lower the property’s value significantly.

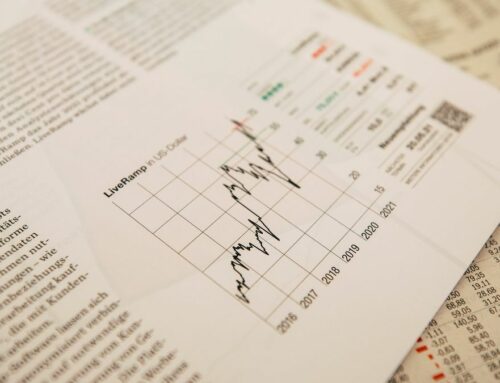

The strength of the real estate market

Over time, the real estate market a property is in can change. This is why institutions should consider a re-appraisal or evaluation for properties after an institution-determined length of time has passed.

For example, the volatility of the local market can have a negative effect on the property’s value if there have been major negative changes to the surrounding areas.

Another serious determining factor is the change in supply and demand of an area. Too little or too many competing properties can make a property’s value take a hit.

If there was a recent natural disaster in the area, it is pretty certain that a new property valuation will be needed.

Lastly, financial changes such as financing availability, interest rates, term changes, and capitalization rates can impact the value of a property and whether or not a previously-completed appraisal is still accurate.

Performing the Validation Process

In order to perform a validation, your institution should complete the following steps:

- Review the original appraisal

- Do some research to identify value trends

- Complete a thorough site inspection and inspection of the surrounding neighborhood

Regardless of any change, the validator should document and file the process for future reference. If there was a positive or no change, then a new appraisal is not necessary. However, if there was a negative change, the validator should request a new property appraisal be completed.

The Different Validation Methods

In order to perform the validation process, there are three methods you can use depending on the type of property being evaluated.

Firstly, there is the income approach. This approach works best for leased properties (such as industrial, office, or retail). Additionally, it works well with apartment projects or hotel properties. In order to use the income approach, you will need to get the income and expense information from the property owner. Next, you can compare this data to the market rent and expense data. By also analyzing the market vacancy and capitalization rates, you can get an overall view of whether or not the value of a property has changed.

Also, there is the sales comparison approach. This approach is used with properties that are owner-occupied or income-producing. In order to use this approach, you can use a variety of sources to get the sales data for the property. Then, you can compare the value indications to their prior value.

Finally, the last method is the cost approach. You should use this approach for special-use properties. This approach looks at the land value trends and building costs. Additionally, it looks at the overall physical condition and compares it to the previously-completed appraisal.

Validating An Appraisal for A Property is Important

Although this may seem like an unnecessary step at times, a property appraisal validation can benefit your institution in many ways. By looking at the complete picture of the property and understanding the factors that can impact its value, you can make crucial decisions that can shift how the property is valued and whether or not there are negative changes since the last appraisal was completed.