Between rising inflation, the pandemic slowing down, and people finding a new “normal,” the real estate market has fluctuated a lot in the past year with many people wondering “will commercial real estate prices fall?”. As we look towards the end of this year and forward, making predictions about the commercial real estate market can help us better prepare and understand what buyers are looking for through commercial real estate appraisal.

</code

Market Trends: Will Commercial Real Estate Prices Fall?

To begin, let’s look at what the commercial real estate market has looked like recently and how that can help us predict future trends.

For example, DealPath explains that the total commercial sales in 2021 were around 809 billion, which was much higher than the two years prior. We also saw this trend moving into the beginning of 2022, as CoStar mentions that lower interest rates drove investors to purchase more commercial properties in Quarter 1.

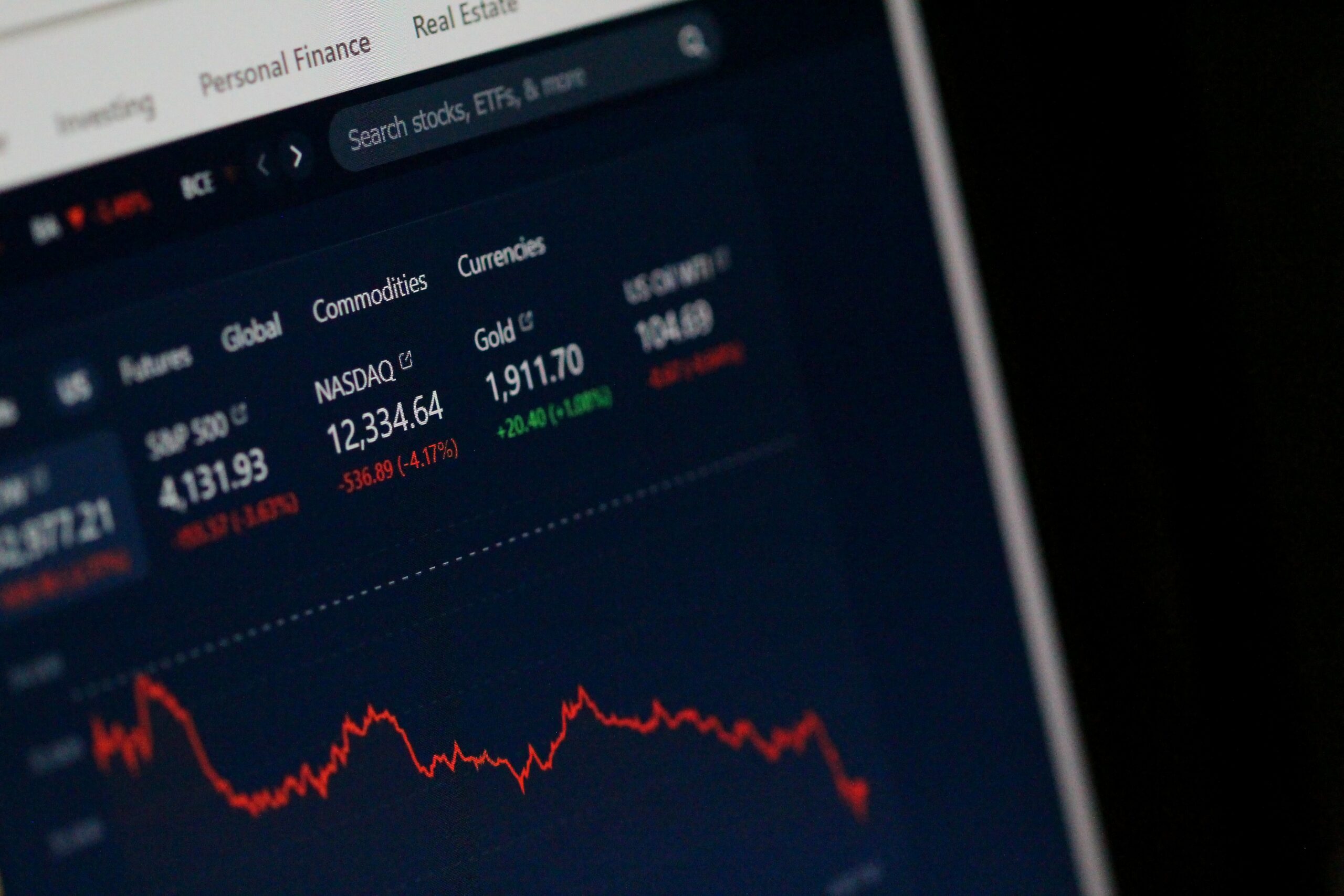

However, just because trends were rising in the past does not mean that they will always stay that way. One major issue that lenders have run into is the rising federal interest rates that have caused buyers to be wary of entering into new loans and purchases. We are also seeing record high inflation that leads to property prices increasing as well, making the entire investment for a buyer significantly higher than found during Quarter 1 of this year. Both of these issues, along with banks being less willing to open up new loans due to the uncertain conditions, can lead to potential commercial real estate market issues in the future.

Possible Futures

In the immediate future, the prospect of commercial real estate isn’t promising. After reviewing the most recent data from Quarter 2, banks are releasing their results as well as making predictions for the rest of the year and beyond.

For short-term predictions, many banks are planning for the market to continue to slow down, especially because interest rates are still rising along with inflation–something to pay attention to especially in the context of commercial real estate appraisal.

On the other hand, according to CoStar, the outlook for long-term commercial real estate could go one of two ways. If the U.S. enters a recession as many believe, borrowing and lending for commercial real estate will continue to fall downwards as it becomes more difficult for investors to purchase properties. This would make it harder for the real estate market to recover to the same levels we saw in 2021, although we do know that it is possible based on historical economic trends.

On the other hand, the same article mentions that the Mortgage Bankers Association has a better outlook for the future if a recession is not involved, including $872 billion in commercial real estate lending–meaning 2023 would be the highest-grossing year for commercial real estate in 5 years. They also mention that there are not any current signs that would point to a major crisis, making this a valid option for the future.

Another article in Forbes by Aviva Sonenreich holds the same belief. The article discusses many predictions for the rest of 2022, including a bounce back in commercial real estate, an increased supply chain, and increased sales in each of the individual commercial markets.

These are two very different possibilities for the market. However, only time can tell what the future holds. Obviously, the key to commercial real estate trends is to stay on top of them. They are ever-changing and the only way to understand which direction the market will go is to follow trends and quarterly reports throughout the year.

This is also where accurate appraisals can come in handy. By understanding the current value of properties and comparing it to the past, we can have a better idea of where a property’s value could be headed in the future.

How Are Different Commercial Markets Being Affected?

CoStar mentions that overall, banks are reporting a decrease across the board in commercial mortgages, with a projected 18% yearly drop across the board. But how are individual markets being affected?

Multifamily lending is expected to see a large decrease as prices increase, although some might say it has the possibility to stay steady due to the increase in rental prices across the country. This could make the investment worth it for some, if the price is right.

In J.P. Morgan’s 2022 midyear outlook, they break down how retail, multifamily, office, and industrial properties have done so far and where they are projected to go. In their outlook, they explain that industrial properties have seen some of the most growth so far in 2022, and it is expected that they should continue to grow.

However, an area of concern is office space as businesses are still contemplating the role of the pandemic and how it has changed what the typical workspace looks like. On the other hand, this is where retail properties have the potential to thrive, as people do not always turn to e-commerce for their purchases and services.

How Does This Information Affect Commercial Appraisals?

With the possibility of commercial prices falling and the rise of interest rates not seeming to slow down, appraisals are affected in multiple ways.

First of all, fewer property investors lead to fewer properties for valuation comparison. This makes it harder to come up with an accurate appraisal because recently sold properties of the same classification would not have any examples to work from.

Additionally, higher interest rates lead to an overall lower property value, according to CoStar. Because interest rates are continuing to climb, the value of the property (although it may be higher than in past appraisals) is cut down by the amount in interest that would be required. Investors know that appraisals will be lower, leading to a decrease in commercial real estate sales overall.

The appraisal of a commercial property is a direct reflection of whether or not buyers are willing to invest. In order to get the most accurate data, a bank’s appraisal process would have to take into consideration inflation and interest increases. In addition, the uncertainty surrounding the economy not only makes it less likely buyers will invest, but also makes bank lenders wary of originating new loans. They may not want to take the risk that we will move into a recession, leading to payment issues and other economic concerns.

So, Will Commercial Real Estate Prices Fall? Maybe

Unfortunately, when it comes to market economics there are no sure bets. It is impossible to come to an exact determination of whether or not commercial prices will fall. However, accurate commercial real estate appraisal can make it easier to assess the trends of commercial real estate and can help banks understand what a buyer is looking for. It can also help them make determinations on originating new loans and preparing for an uncertain future. No matter whether we move into a record-breaking year or see an economic recession, commercial real estate is a major part of our economy and will continue to be an important investment opportunity for willing buyers.

If you have any questions regarding commercial real estate appraisal or require our nationwide virtual appraisal services, contact us today!