BLOG

How Accurate is a Commercial Real Estate Valuation?

Having an accurate commercial real estate valuation can make or break a property’s value. It is truly in the client’s best interest to have an accurate appraisal, so they can move forward with the property. However, there are so many factors that go into a valuation that many may wonder whether or not a real estate valuation is accurate. Here are three ways to ensure an accurate appraisal for a commercial property.

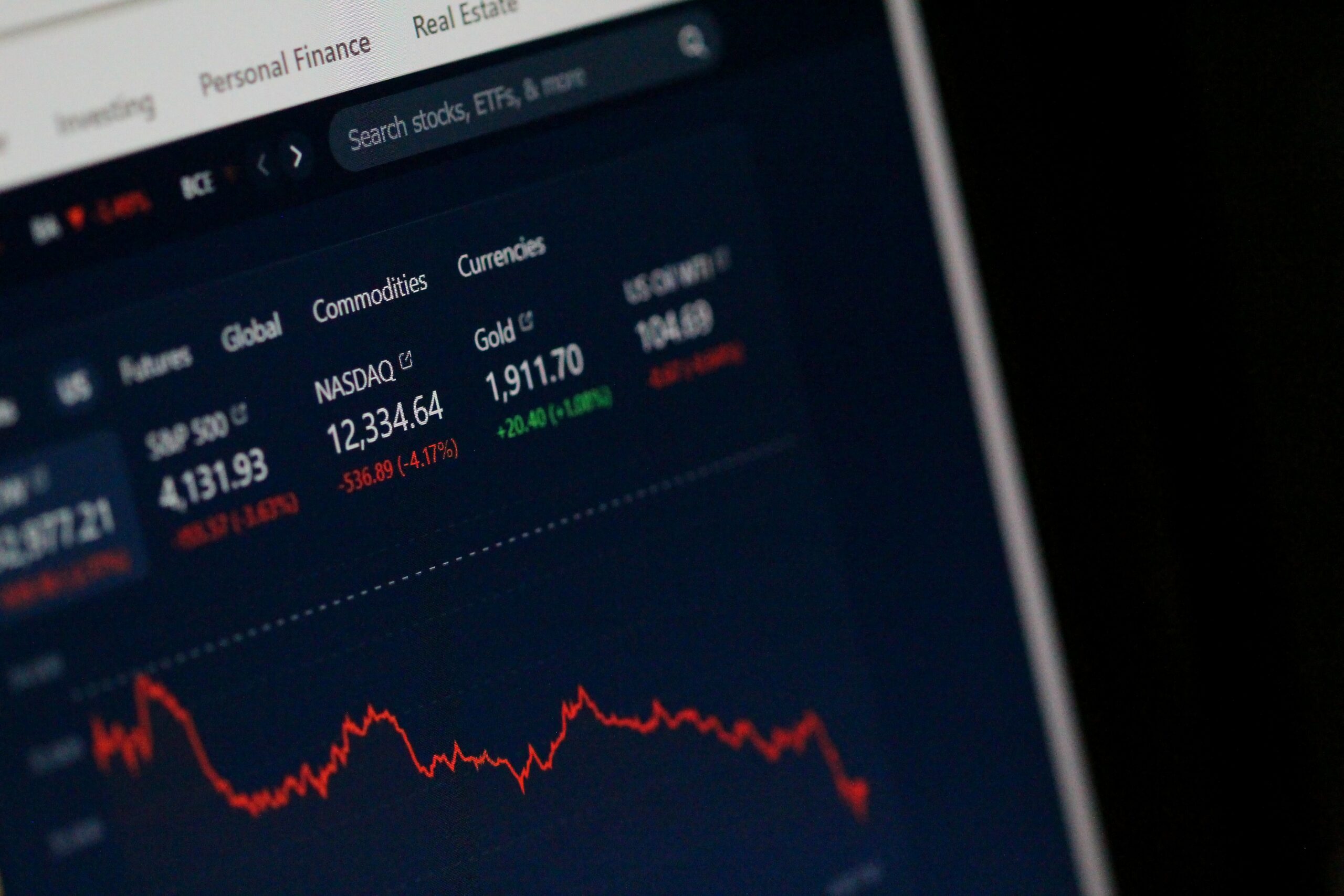

Will Commercial Real Estate Prices Fall?

Between rising inflation, the pandemic slowing down, and people finding a new “normal,” the real estate market has fluctuated a lot in the past year. As we look towards the end of this year and forward, making predictions about the commercial real estate market can help us better prepare and understand what buyers are looking for.

Are Floorplans and Sketches of homes Infringements of the Copyright Act?

Is it now a copyright infringement for appraisers to produce floorplans or sketches of the properties they are engaged to appraise? Possibly…

The Importance of Validating a Previous Appraisal

With market conditions always changing, knowing how to validate a previously-completed appraisal or evaluation is essential for all banking institutions. Validating a property’s appraisal allows you to determine whether or not the previous appraisal is still a valid assessment of the property’s value.

Using the Total Excess Earnings Model to Determine Tangible and Intangible Assets

There are many ways to figure out the value of real estate property. However, one method that is extremely efficient at determining the value of tangible and intangible assets is the Total Excess Earnings Model (TEEM).

How to Perform an Internal Controls Audit of Your Bank Appraisal Department

CES sees a lot of SBA involvement on many appraisal requests lately. SBA can be an excellent support to banks from a risk management perspective, but there are issues unforeseen by SBA and most bankers for even relatively small transactions. Furthermore, most of the points made in this brief article are applicable too many non-SBA transactions.